California’s minimum wage and overtime-exempt salary threshold will rise in 2019 at different levels depending on employer size. Complicating matters, many cities and some counties in the state will also raise their own minimum wages. Here’s what employers should know for 2019.

Statewide California Minimum Wage

The state minimum wage will continue to rise each year until it reaches $15.00 an hour in 2022 for large employers and in 2023 for small employers. This year’s increases are as follows:

As of January 1, 2019:

Employers with 26 or More Employees: $12.00 an hour (from $11.00)

Employers with 25 or fewer employees: $11.00 an hour (from $10.50)

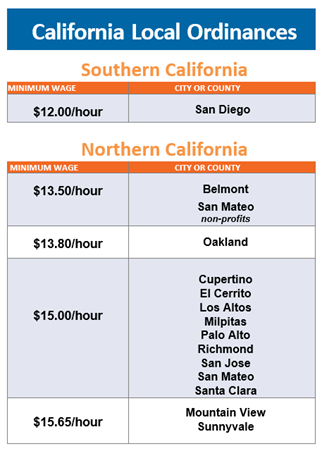

City and Local Ordinances

A number of cities and counties have their own minimum wage ordinances, some of which go into effect in January and others in July. San Jose, for example, will reach the $15.00 an hour minimum threshold on January 1st, 2019 while San Francisco will do the same later in the year in July.

For a full list of local minimum wage requirements and employment ordinances, click here.

Your Business Impact: Where is the Work Performed?

To complicate matters further, if any employees perform work of 2 or more hours in any of the cities or counties that have their own minimum wage ordinances, then the employer may be obligated to pay a higher local hourly rate then the state minimum wage above.

Exempt Salary Threshold Requirements

In California, the exempt salary threshold for executive, administrative and professional exemptions to the state’s overtime laws is directly tied to the state’s minimum wage. That means that when minimum wage goes up, minimum salaries do too. In addition to meeting certain duties tests, exempt employees in the state must earn a fixed monthly salary of at least double minimum wage for full-time employment. Local minimum-wage ordinances do not affect the exempt salary threshold.

The exempt salary threshold increases for January 1st 2019 are as follows:

Employers with 26 or more employees: $960 weekly, $4,160 monthly, or $49,920 yearly

Employers with 25 or fewer employees: $880 weekly, $3,813.33 monthly, or $45,760 yearly

Failure to adhere to salary threshold increases for exempt employees can result in hefty fines and penalties including back pay for employees and possible litigation.

Emplicity understands that HR Outsourcing should be simple and meaningful. As a Professional Employer Organization (PEO), we strive to be a great partner in supporting your business. If you would like to request more information on how we can assist your needs, please reach out to us at 877-476-2339. We are located in California – Orange County, Los Angeles, and the greater Sacramento and San Francisco area.

NOTICE: Emplicity provides HR advice and recommendations. Information provided by Emplicity is not intended as a substitute for employment law counsel. At no time will Emplicity have the authority or right to make decisions on behalf of their clients.