As a result of Senate Bill Number 3, passed by Jerry Brown back in April of this year, California has begun its ascent to reach a $15 minimum wage by the year 2022. California’s minimum wage reached $10.50 on January 1st, 2017 for businesses with 26 or more employees, but smaller business will see their first rate hike on January 1st, 2018.

As a result of Senate Bill Number 3, passed by Jerry Brown back in April of this year, California has begun its ascent to reach a $15 minimum wage by the year 2022. California’s minimum wage reached $10.50 on January 1st, 2017 for businesses with 26 or more employees, but smaller business will see their first rate hike on January 1st, 2018.

The state-mandated, January 1st increase in minimum wage will not affect certain municipalities that are already at a rate higher than the state minimum, including but not limited to Los Angeles, Pasadena, Santa Monica, Emeryville, and San Francisco; however many of these cities and counties will have their own increases that they will be rolling out between January 1st and July 1st.

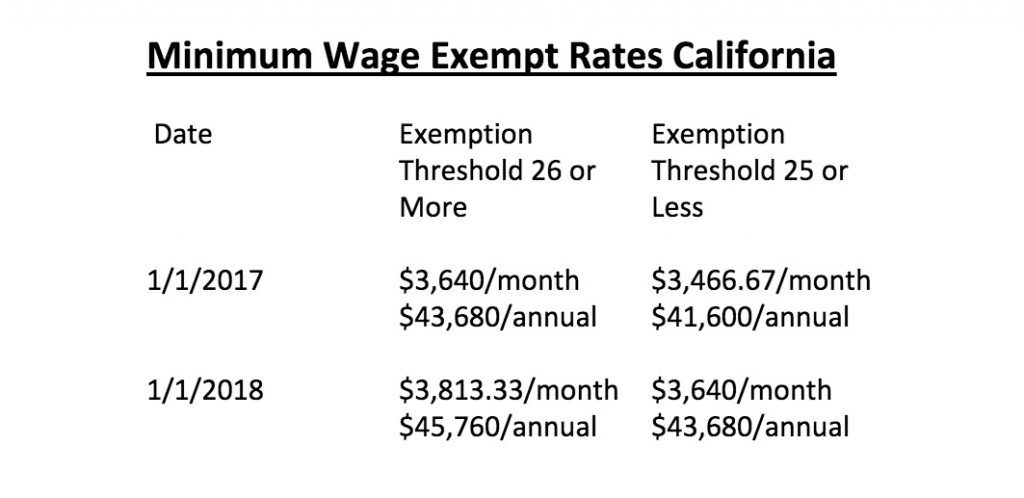

Salaried employees may also be effected and, with few exemptions, the below increase will go into place for salaried, exempt employees:

As local and state wage laws get increasingly complicated. It’s up to employers to keep up with new bills and ordinances – or face large fines and even litigation. Another great option to ensure compliance is bringing in a PEO (Professional Employer Organization) firm under which an employer can outsource employee management tasks, such as employee benefits, payroll and workers’ compensation, risk/safety management, wage and hours management and more.

Emplicity understands that HR Outsourcing should be simple and meaningful. As a Professional Employer Organization (PEO), we strive to be a great partner in supporting your business. If you would like to request more information on how we can assist your needs, please reach out to us at 877-476-2339. We are located in California – Orange County, Los Angeles, and the greater Sacramento and San Francisco area.

NOTICE: Emplicity provides HR advice and recommendations. Information provided by Emplicity is not intended as a substitute for employment law counsel. At no time will Emplicity have the authority or right to make decisions on behalf of their clients.